Since its signing into law by President Franklin Roosevelt on August 14, 1935, the Social Security Administration has helped millions maintain a monthly benefit to support their families. Initially established as a program to keep families out of poverty, the benefits from social security have taken a more substantive role in the finances of families.

With fewer corporations providing workers a pension plan for lifetime benefits, social security benefits have taken the role as a primary income item for most families. Failing to save for retirement is a terrible and tragic mistake. Longevity has improved for Americans due to the improvement of medicines, treatments, and advancements of surgeries. If we are going to live longer, shouldn’t we consider it may take more assets to support our lifestyle?

The original law included benefits for individuals aged 65 and older that participated in paying their share of the premiums for the benefits through their employment. Your employer pays half of the obligation. The initial purpose of the law was to address the period after a person finished working (i.e., retirement).

Over the decades, the Social Security Act has been amended for other purposes. It does make sense that the loss of a family member who is responsible for a substantial portion of the financial support would need their income replaced. Of course, life insurance is a simple manner of replacing lost income for the family, but many companies do not provide life insurance to their employees. To solve the problem, and to keep families from facing poverty, the Social Security Administration was authorized to assist families with survivor benefits. To qualify, the surviving spouse must be the caregiver for a disabled child or a child under the age of 16. Some other qualifications are required as well.

The logic behind this process of granting survivor benefits is that the deceased participant would not be receiving the benefits they may have been entitled to now or in the future. Payments do not last forever, and the child will eventually lose the monthly payments due to age unless disabled.

If a person became disabled before reaching their Full Retirement Age (defined as either age 66 or 67 depending on your year of birth), she may qualify for disability benefits from the program. Additional qualifications are expected before granting the benefits.

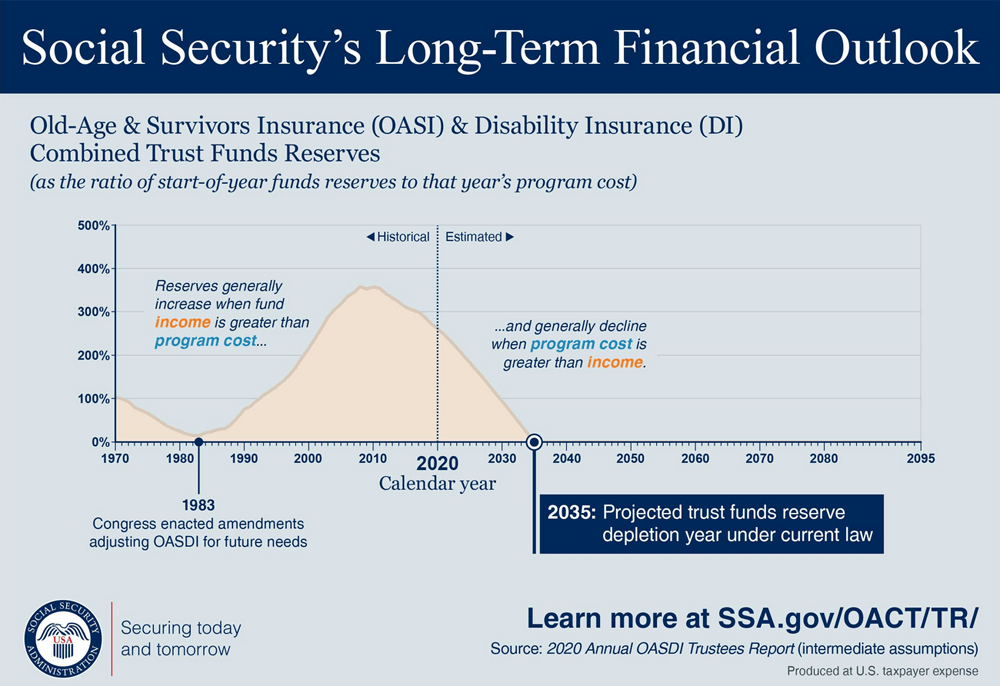

These amendments and granting of benefits for other reasons than retirement have caused concern that the Social Security Program will become incapable of funding benefits at their current levels by 2032. Today, there are two people paying into the trust fund for benefits for every beneficiary. This is unsustainable.

Congress should review the current funding and obligations of the program to make reasonable changes. For one, the amount contributed could be changed by 1% and would extend the funding for the program for many years. The program could increase the age for full retirement benefits to 68 which would save the plan’s longevity for many years.

Lastly, it would be a start to allow a privatized portion of the social security premium contributed by each worker. Start with a smaller percentage such as 15% and allow the individual to direct the investment strategy to meet their personalized needs.

No matter what the approach to resolve the problem with funding, something should be done soon. There is no concern for current beneficiaries being affected. However, individuals ages 25 – 40 may see a far different benefit program when they are retirement age.

It is important to be proactive when planning for retirement. Think about your goals for the future and seek out a Certified Financial Planner™ professional to create a plan for achieving them. The future is predictable if you work toward the goals you wish to accomplish. Warren Buffett offers us some good advice about saving for the future when he said, “If you spend money on things you don’t need, soon you’ll have to sell the things you do need.”