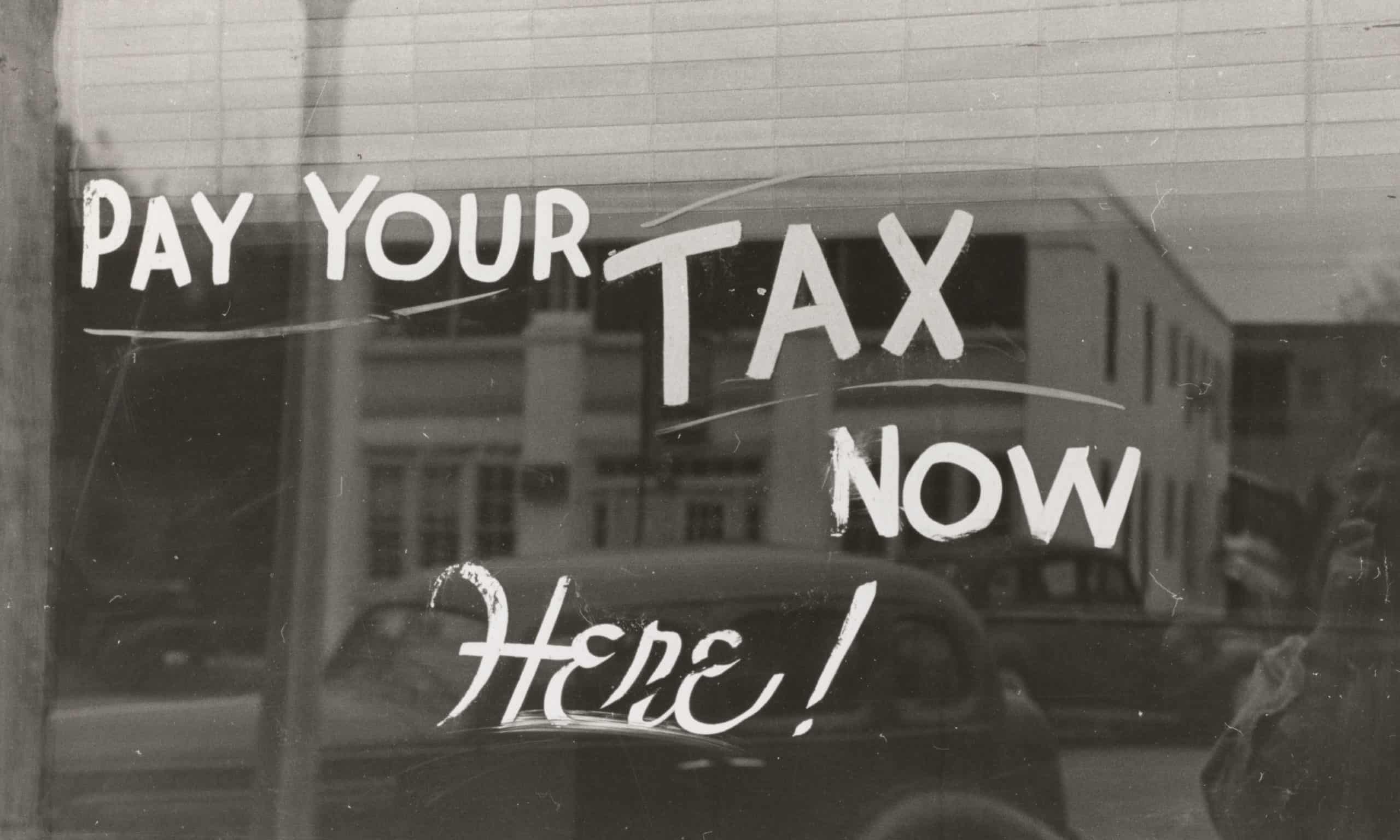

The taxman cometh! Every year at this time, individuals in our great country are asked to file their income tax returns to contribute a portion of their earnings to the common good. Some of us are immune to this exercise in honest reporting due to income levels. Others are subject at the highest rate of taxation allowed by law. All of us owe a duty to maintain the republic in revenue that we lawfully owe.

Due to the pandemic, many companies were subjected to slowing, or ceasing, supply lines that caused temporary, or permanent, layoffs of workers. In the past couple of months, some of the largest employers on the planet have given notice that they will be reducing their workforce due to the current economic climate. For example, according to a CNBC article published on January 18, 2023, more than 70,000 individuals lost their jobs in the past three months from companies such as Google, Meta, Microsoft, and many other giant technology companies.

What does one do when their means of earning a living has been eliminated? The state in which you reside generally provides temporary unemployment benefits to assist you in transitioning to another job. What many people don’t realize is that the benefits paid them are also taxable on their income tax return. Does this seem fair? From a purely theoretical tax law perspective, the taxation of these benefits is correct. This series of payments you are receiving to substitute, although in most cases at a lower level than you earned your wages, income for purposes of living expenses does, in fact, improve your cash flow. Many people fail to consider their marginal tax rate when receiving these payments and owe taxes on the money when their return is filed.

This year individual tax filers will receive a little extra time to file their 2022 income tax returns. Due to a federal holiday and April 15 landing on a Saturday, your income tax return is not required to be filed until April 18, 2023. However, it is my recommendation that you not wait until the due date to start the filing process.

Tax rates ranging from 10% to 37% are reasonable in respect to some other countries. Congressional leaders argue as to the fairness of our tax code. However, it has been proven that the top earners in our country, the labeled “1%”, do, in fact, pay 42.3% of the total income tax collected on earnings of 22.2% of the income according to the Tax Foundation, a non-profit think tank. Those taxpayers at the bottom of the earnings schedule took home 10.2% of the total income of the United States and paid 2.3% of the total taxes collected.

Our system of taxation does work, perhaps not perfectly, but functionally. One of my mentors asked me how I felt about being able to pay my debts including my taxes. My philosophy has been one that I truly wish to pay my family’s fair share of its debt to this great country. To pay taxes at the highest rate of taxation is to say our family enjoyed a prosperous year. Too many of us seek a means of reducing our tax burden by illegal means (i.e., dealing in cash, embellishing our expenses or deductions, etc.). It is incumbent on all of us to be honest and willing participants in this self-assessing system of taxation for our country to function properly.

Regarding the 87,000 IRS agents to be hired by the agency, there are many rumors about the types of employees and their focus in the collection and enforcement process of the U.S. Treasury. It is unfathomable to think that agents toting guns will be coming to a peaceful business to enforce collection of a tax that is voluntarily assessed and paid. However, the focus of these new agents will be directed toward those taxpayers who flaunt the system and intentional fail to report their earnings properly.

I have used this quote many times, but it is no more appropriate than at this time of year: “Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” – Judge Learned Hand

If you wish to lower your tax burden, consider a complimentary consultation with a Certified Financial Planner™ professional. By developing a plan to legally reduce your tax burden each year, you may save additional funds for other important matters in life. See you on the jogging trail!