If there is one thing in life you can count on, that would be income tax changes! Over the past few months, we have seen changes in our world that create anxiety for many people – elections, natural disasters, COVID-19, etc. One of the best methods of understanding the factors of anxiety is to acknowledge who controls the process – you. I’ve said it many times, but it is most important that you invest in yourself by taking care of your mental health. By feeding on a diet of negative news on the TV, you implant in your brain the thoughts that control your psyche for the day. Rather than listening to or watching these events that cause you to be anxious, consider reading a good book or walking in the park to gain a fresh perspective about life.

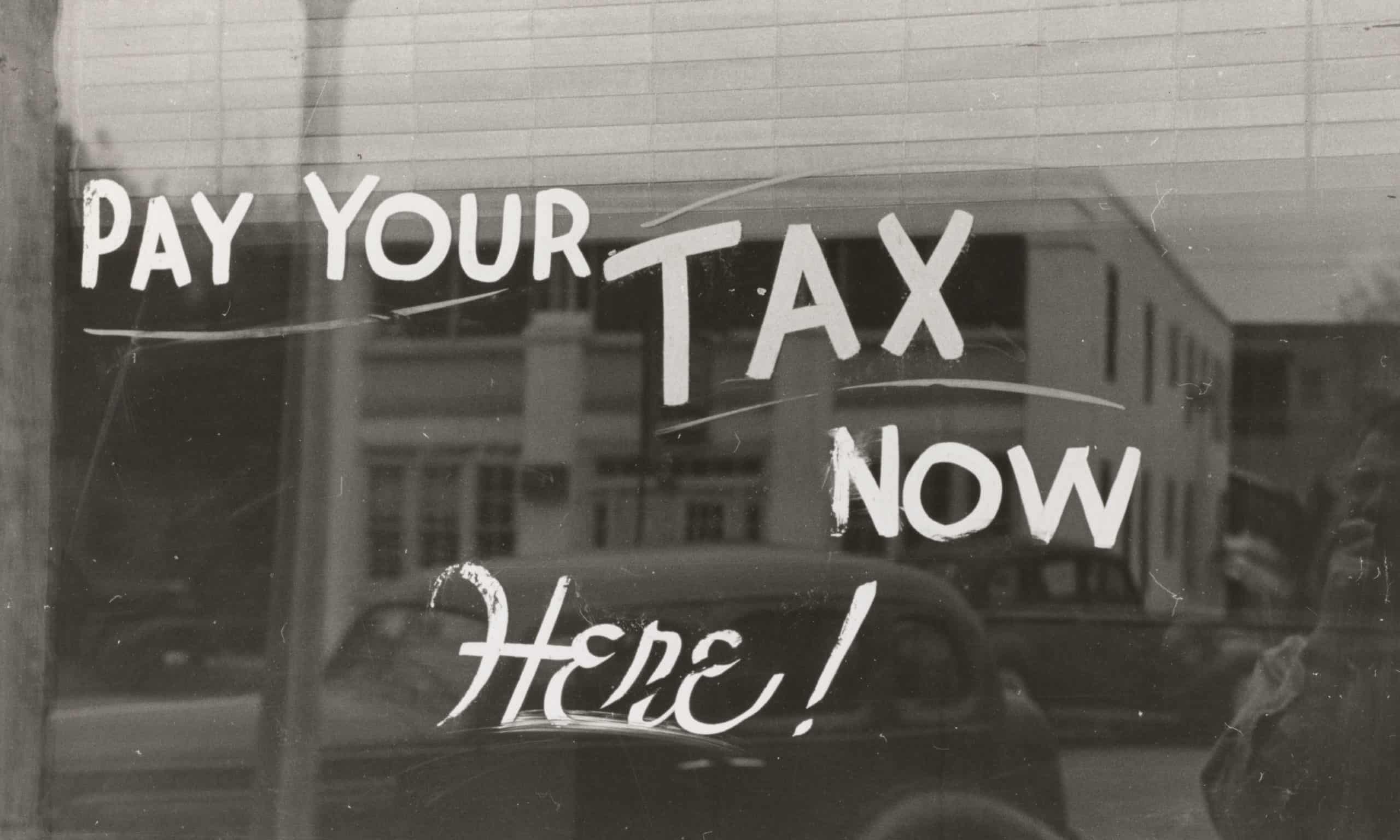

We can’t totally ignore life because we do owe a duty as citizens of the greatest country on the planet. Annually you are asked by the federal, state and local governments to report certain assets, income and other activities for purposes of paying your fair share of the burden to live in a civilized society (well, somedays it may not seem civilized, but it is). Former Justice of the Supreme Court, Oliver Wendell Holmes, coined the phrase applying taxation as the price for a civilized society but, as citizens, we are owed a duty by those elected to represent us to utilize our taxes in a meaningful way that brings order to our world.

Before you file your 2020 individual income tax return, you may want to consider these important changes that may help your family. President Trump signed the Consolidated Appropriations Act, 2021on December 27, 2020. The law impacts individuals in a manner that helps provide family support and small businesses with additional payroll assistance.

No doubt you have watched the news lately and determined that your bank account may contain $600 more than you originally noted. For those individuals who filed electronic returns for 2019, and whose bank information was on the return, many received their stimulus payments the first week of January. One misunderstanding about the Recovery Rebate Credits of $600 is that the payment is a credit against 2020 income taxes. Individuals with adjusted gross income in excess of $75,000, or joint filers with adjusted gross income in excess of $150,000, are not eligible to receive the stimulus payment.

Teachers also receive additional relief for personal protective equipment costs that may be deducted as qualified educator expenses. This above-the-line deduction is helpful to reduce adjusted gross income which lowers the overall hurdle of other expenses the family may incur such as medical expenses that are deductible as itemized deductions.

If you are unable to itemize deductions but wish to continue to support your local qualified charitable organization, you may do so. The law changes in 2020 allows an above-the-line deduction for qualified charitable donations in the amount of $300.

As we begin a new year for our lives to enjoy, it is critical that we recall the reasons for the founding of the United States of America. The preamble to our constitution provides us a goal for which we must, in a collective manner, strive toward: 1) establish a system of laws and justice equally applied to all citizens; 2) create and maintain a defense of our nation from enemies; 3) promote the general welfare of our citizens; and 4) secure the blessings of liberty. We are a nation of people with one common interest – freedom. Our nation is the beacon to all other nations on the planet as an example for true independence and the opportunity for every citizen to be successful on their own terms. Happy New Year!