Live A Life By Design Blog

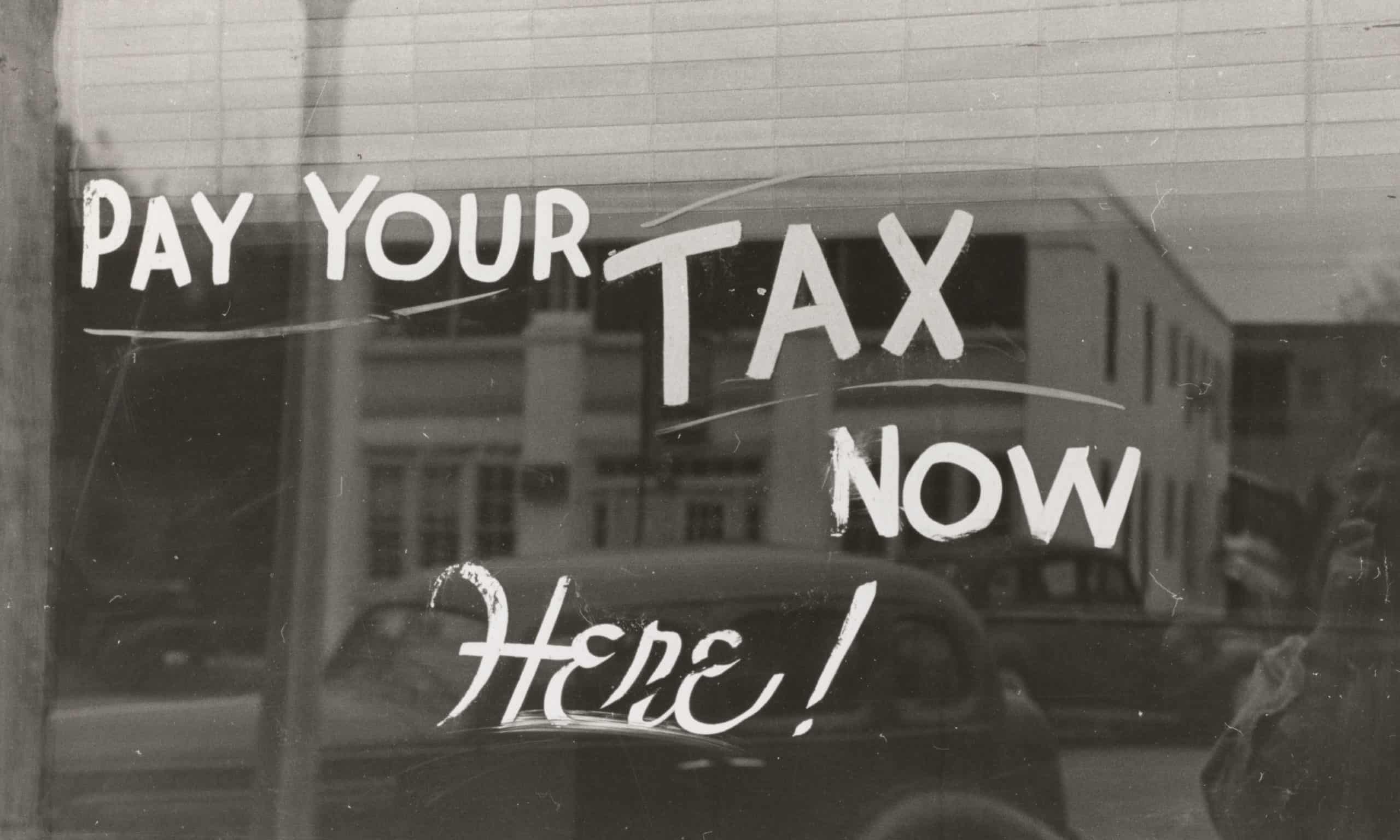

The Taxman Cometh

Only two certainties remain in life – death and taxes. These two actions require a significant commitment from you in terms of time and money. It is important that we each carry a portion of the costs of the freedoms we enjoy in the United States of America. A phrase often quoted by the leaders […]

Don’t Leave Your Money Behind When You Leave a Job

If you were to leave your home and move to another one, would you leave your valuable jewelry and other assets with the old home? Of course not! In a similar sense, millions of Americans leave their place of employment and fail to protect one of their most important assets after the change in employment […]

“During” Retirement is Different than “To” Retirement

Work, work, work! This is the metronome of our lives for more than 40 years of our existence. My father was an excellent instructor on life as he dispensed exorbitant amounts of wisdom to me while growing up. Some of his sage advice, not original to him, was “you don’t have time to do it […]

Life Isn’t “Set it and Forget it”

“It’s the end of the world as we know it,” as the pop singer bellows out the first line of the chorus of a top song for their band. What a profound statement when we think of the chaos of the past few years and the impact economic factors have made on your net worth. […]

It’s Tax Time! Are You Ready?

The taxman cometh! Every year at this time, individuals in our great country are asked to file their income tax returns to contribute a portion of their earnings to the common good. Some of us are immune to this exercise in honest reporting due to income levels. Others are subject at the highest rate of […]

Predicting Your Future

Prior to starting the new year, many of us sat down with a pen and paper to develop our desired goals for 2023. Well, some of us did. Gallup, a national polling organization, studied goal setting by U.S. citizens and the results are encouraging. The findings were that 79% of adults age 18 – 34 […]

New Retirement Changes That May Secure Your Future

One of the best attributes about my profession is the constant change in the rules for which we give advice to our clients. One of the worst attributes of our profession is the constant change in the rules for which we give advice to our clients. This double-edge sword keeps our team of professionals motivated […]

How Successful People Gain and Retain Their Wealth

There is a TV show that I witnessed a couple of times that is titled, How Winning the Lottery Ruined my Life, or something to that effect. While watching the “lucky” family discuss their travails and trials of winning such a large sum of money when they previously were considered poor or bankrupt was interesting […]

Tax Credits for Homeowners

Home ownership avails tax deductions such mortgage interest and ad valorem taxes for those individuals that itemize on their personal income tax return. Deductions are good since they reduce your taxable income; however, tax credits are much better since they reduce the tax itself dollar-for-dollar. One of my mantras when helping our clients with tax […]

To retire, overcome these three challenges

Retirement planning of itself has many challenges for individuals. It is an area of life that has many concerns and questions because of the unknowns in the future. It is as the Boy Scouts would say, you must be prepared for anything. To help you accomplish your goal of retiring with a worry-free lifestyle, we […]