Live A Life By Design Blog

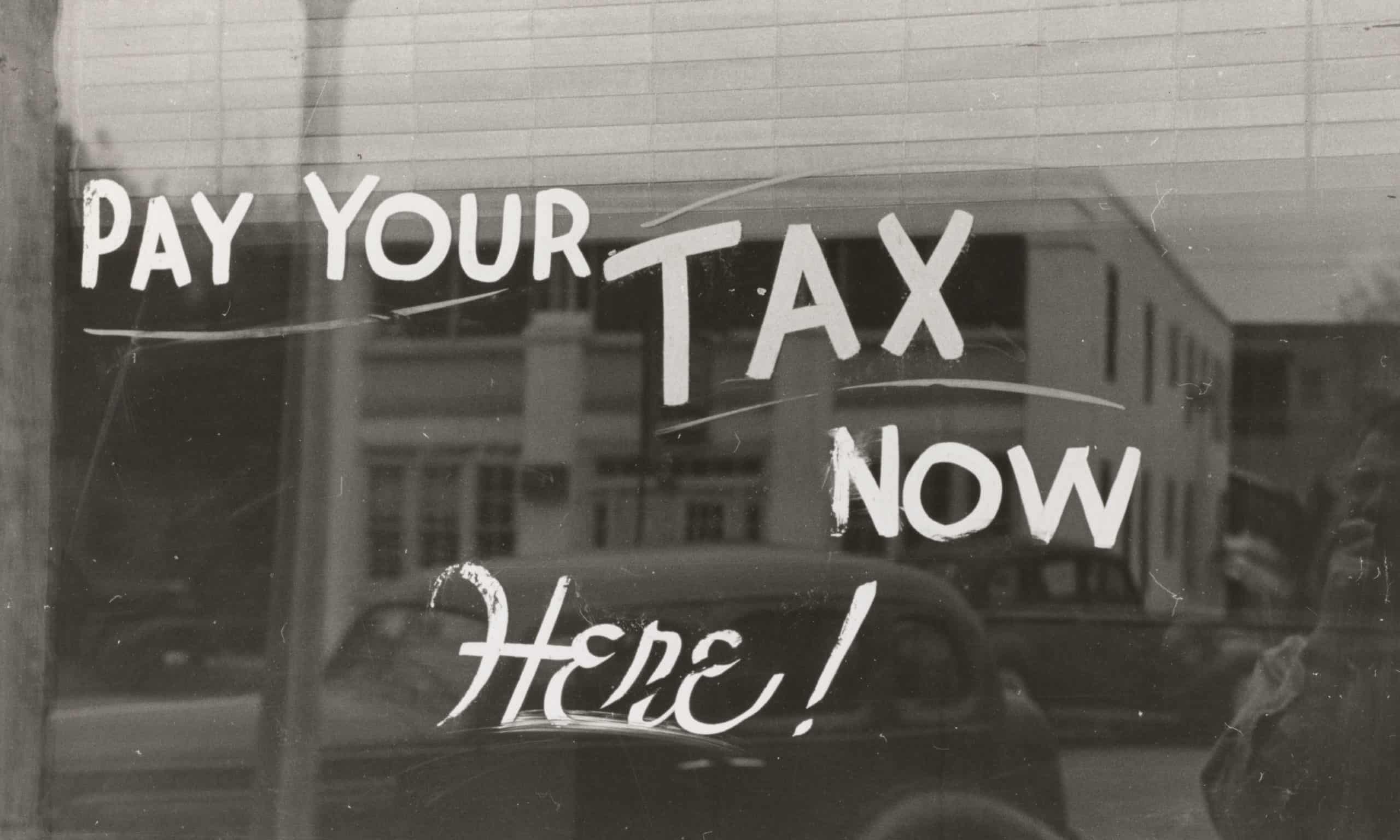

Want Less Stress at Tax Time? Do This!

Are you one of those people who lose sleep at night, suffer anxiety and, generally, feel miserable when it is time to file your individual income tax returns? One of the best methods of experiencing a better way of life is to take charge of the activity. Don’t allow yourself to procrastinate on this important […]

Time is Running Out

As a calendar-year, cash-basis taxpayer, you will have fewer opportunities to reduce your 2019 income tax burden once the calendar rolls over to 2020. By taking a few simple steps today, you will see a better result when you file your income tax return in April, 2020. If you participate in a Flexible Spending Health […]

Thanksgiving – Wealth Is More Than Money!

It is that time of year when each of us should pause and reflect on the life we lead in the United States of America. While our nation is far from perfect, the freedoms, opportunities and rights we claim are superior to any other nation on the planet! I am often asked how I define […]

3 Mistakes Most People Make With Their Retirement

During my thirty year career of guiding individuals to realizing their retirement goals, I have reduced the most critical of mistakes people commit when accumulating retirement assets in their employer’s plan. These mistakes can be overcome and people have a higher probability of reaching their intended goals. Mistake #1: Making Decisions through Fear Investing should […]

Simplify Your Life, Consolidate Your IRAs

Diversification is a common term heard by most investors. However, its true meaning is sometimes lost. Recently, we were meeting with a new client of ours that is retired. When the woman brought her giant, purple, three-ring binder to the first meeting, we were somewhat puzzled. Near the end of our first meeting, she opened […]

It’s That Time of Year for IRA Owners

For many years you saved taxes by contributing to your Individual Retirement Account (IRA) or employer-provided retirement plan. Now, it is time to retire and the IRS says, “Do you remember all of the tax savings you realized for the past 35 years? We want it back!” Perhaps this is a bit extreme but there […]

It’s All Taxable, Unless…

All of your income is taxable! This is the premise of the United States Government. However, provisions are addressed through tax legislation that allows certain types of income to be partially taxable or fully exempt from taxation. How do you know which income is tax-free? Is it unpatriotic to pay the least amount of income […]

Be Confident In Your Retirement Years

For most investors, including retirees, it is critical that they understand the philosophy of investing. If you utilize the services of a professional to assist with the implementation of your retirement goals, the logical approach to reaching your goals should be understood by all parties. One of the greatest causes of worry and concern, during […]

What Is Causing All of the Market Volatility?

Have you noticed your retirement portfolio activity looking like a bad EKG? Market fluctuations have been extreme the past few months. This type of market experience is a test of your investment philosophy and willingness to “stick with your approach”. Many different factors create market volatility. One area that causes market concerns is the geopolitical […]

Why Your Credit Score Is So Important

Are you considering the purchase of a retirement home? Or perhaps simply leasing a seasonal residence in a retirement community? Your credit score, no matter your age, is critical to managing your financial matters. Let’s discuss the various components and uses of a credit score that will assist you in achieving your retirement goals. If […]