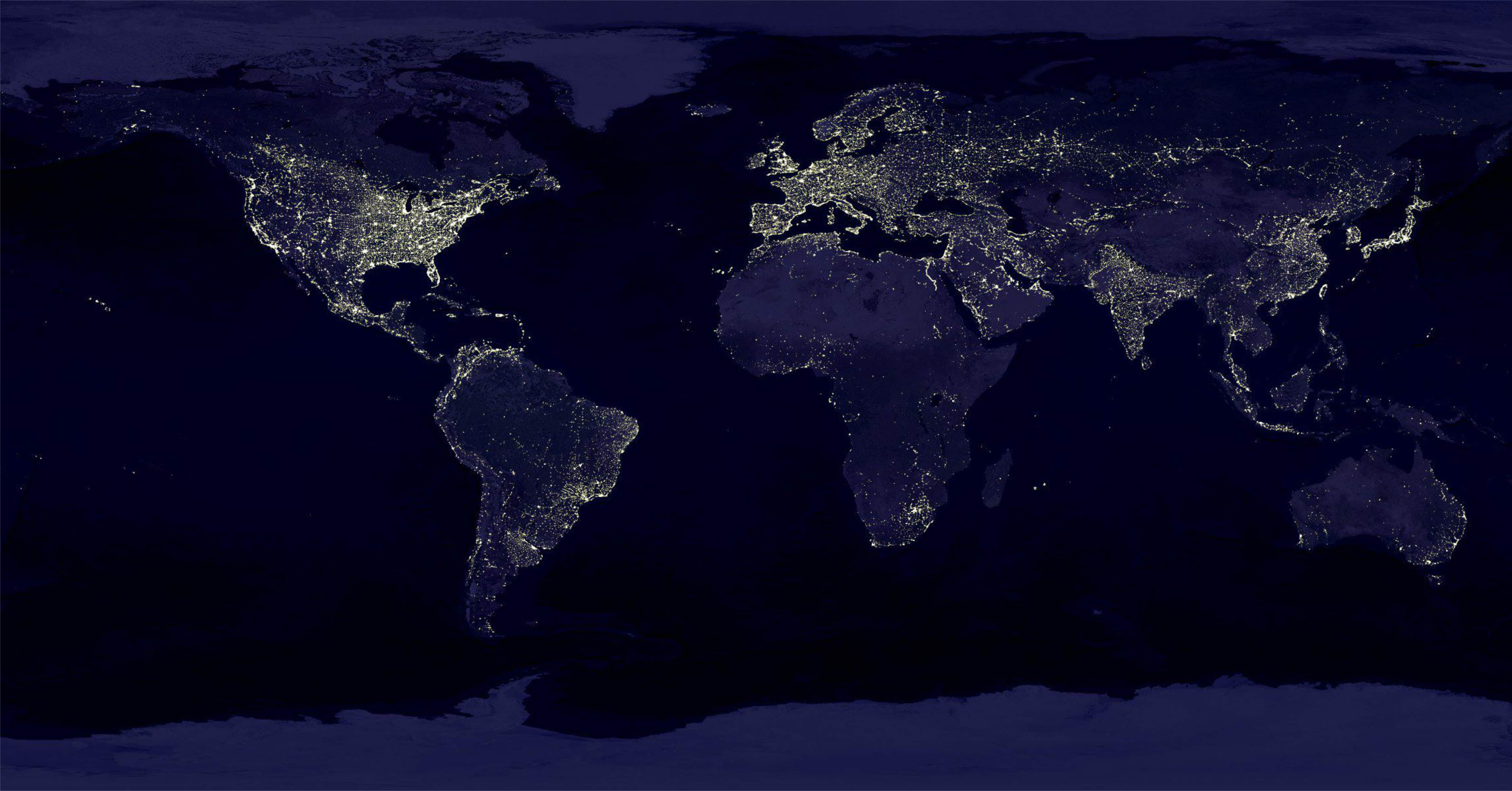

Today, we live in a global economy. Although appearing insulated to the disagreements between countries on the other side of the globe, U.S. markets are negatively impacted nonetheless. How could a political conflict between Taiwan and China create market disruption in the U.S.? This type of risk to markets is called Geopolitical Risk.

One of the most critical factors of any economy is the ability to maintain a steady flow of capital through the production and sale of goods and services to respective markets. When this flow becomes interrupted by governmental policy, military action or social interaction, markets become concerned that buyers and sellers of these goods can continue to make profits, hire employees, obtain raw materials, etc. Recently, political relations deteriorated between China and the United States. Differences in economic goals and outcomes, fair treatment of workers and use of natural resources, or the lack thereof, can impact the flow of goods and services in a significant manner.

Diversification of a portfolio requires far more than simply allocating your assets among different styles of investments such as large capitalization and small capitalization companies. To properly diversify your portfolio, it is critical you analyze the inherent risk in foreign markets including developed and emerging countries. An investor would be required to understand and accept greater risk involved with investing in an emerging market country where transparency and lack of efficient trading occurs more so than a sophisticated and developed efficient trading country.

Based on the World Economic Forum’s Global Risks Report 2020, economic confrontation between major powers is the most concerning risk for 2020. Most recently, the invasion of Ukraine by the Russian Federation presents significant attributes of market disruption. The markets for fertilizers and other natural resources located in Ukraine, in substantial quantities, have been disrupted in the past month. Fertilizer prices rose due to continued high demand and supplies were lowered by the political disruption caused by war.

The pandemic caused by Covid-19 continues to disrupt the free flow of goods from manufacturers in China and the Far East destined for the United States. How does the pandemic affect the flow of goods and materials? In China, a zero-tolerance policy exists in the manufacturing sector. This simply means that the discovery of one case of Covid-19 diagnosed in a worker requires the entire closure of the facility. Let’s assume a plant in China manufactures automobile replacement parts. Demand for these parts remains very high in the U.S. economy. By closing the plant for a period of a week (or for a month as done during the Chinese New Year) will generate less supply for consumers and greater demand for the parts. The result of this imbalance between demand and supply is inflation.

Investing requires an understanding of the functions of foreign and domestic markets, taxation of international imported goods and the impact of geopolitical risks. Most individuals feel ill equipped to make such investing decisions or where to research the matter. Seek out the advice of a CERTIFIED FINANCIAL PLANNERTM professional to help you analyze the risk in your portfolio and provide you opportunities and guidance to reach your lifetime goals. Matt Haig said it best, “Never underestimate the big importance of small things.”