Social Security benefits are considered sacred territory by elected officials due to the large number of voting beneficiaries. This important “third rail” of untouchable programs started with a mission and purpose that was admirable. However, the projection of beneficiaries compared to those taxpayers funding the program has been dealt a significant blow lately.

To provide working families a larger paycheck, the president has recently ordered that all employer withholding for FICA and Medicare contributions from employees be deferred until January 1, 2021. Can you imagine the furor this caused? Although the intent is beneficial for those working, it is not an elimination of the tax from the pay but merely a deferral. This means that you, the employee, will be required to pay the deferral back to the system at some point.

The IRS has not issued guidance on this process for repayment but the deferral will begin September 1, 2020 and continue through December 31, 2020. Let’s look at an example of the additional funds an employee will retain through this deferral period. Assume the weekly salary is $500. An employee’s share of SSA benefits withheld, notwithstanding the Medicare portion of 1.45%, is 6.2% of the gross salary or $31.00 ($500 x 6.2%). As of the date this article was authored, seventeen weeks remain in 2020. This provides the employee with an additional $527 of cash flow for her living needs.

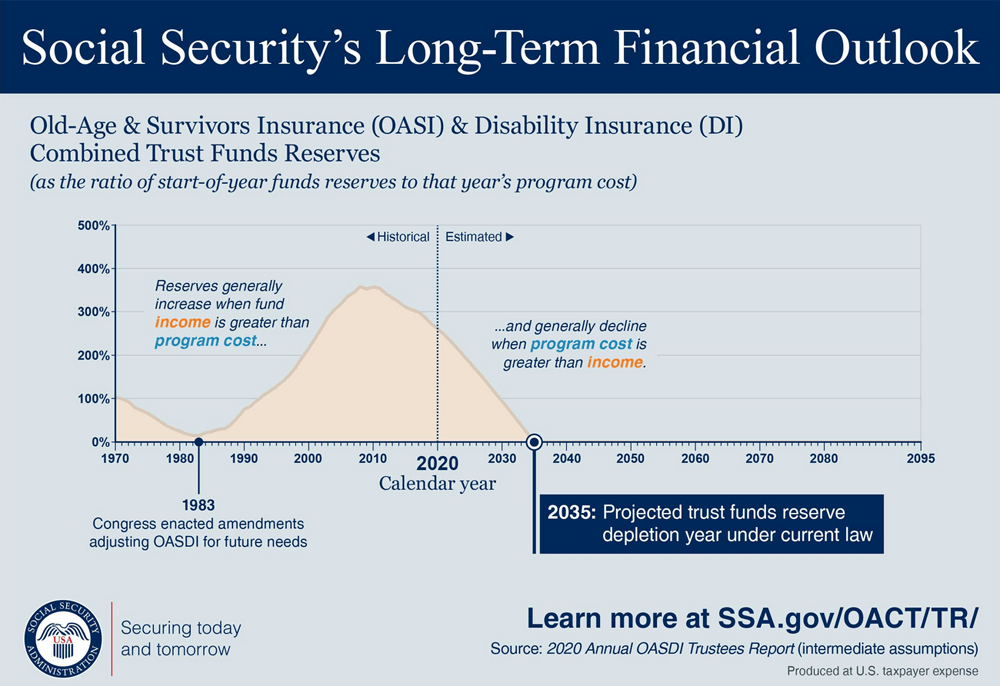

How will this seventeen-week deferral impact the reserves for Social Security benefit payments? The SSA Board of Trustees analyzes the economic projections of the program when issuing their report to the public. Below is a graph reflecting the solvency of the program through 2035 under current funding projections.

By reducing the contributions of working individuals to the program for the short period, officials estimate the solvency would be impaired much sooner. Change creates confusion and chaos soon ensues. This is the current state of the changes to the Social Security Program funding for the remainder of 2020.

What does it mean “the program will be insolvent” in 2035? The SSA Board of Trustees has projected the program can continue to fund existing beneficiaries from current income received by the fund. However, the level of funding will only allow beneficiaries to receive approximately 79% of scheduled benefits. What will this mean for future beneficiaries? An obvious answer I inform younger clients is that the program will be available for them but we are not certain of the benefit structure.

One caveat I would offer is that current beneficiaries will not be impacted by this short-term change. However, future changes of a more sustainable nature should be addressed to continue the functions of the current program. The funding source (employed citizens below the retirement age for program benefits) is shrinking in comparison to the beneficiaries receiving benefits.

It is critical that one does not solely rely on SSA benefits for your retirement income. By becoming self-sufficient for your needs, you will be confident and enjoy your retirement years much more. If you are concerned how the changes to the Social Security Program will impact your retirement decisions, seek out a Certified Financial Planner® professional that specializes in retirement planning. It never hurts to get a complimentary second opinion. See you on the golf course!